Qbse Apps On Google Play

You can ship mileage stories to your e mail or download them from the app. Freshbooks is another full-service expense manager and bookkeeper with a handy mileage tracker. The app is simple to make use of, and is very rated within the app shops by Android and iPhone users. Plug-N-Go is definitely my favorite possibility as a end result of mileage tracking starts whenever you plug your cellphone into your car charger and start driving over 5 MPH.

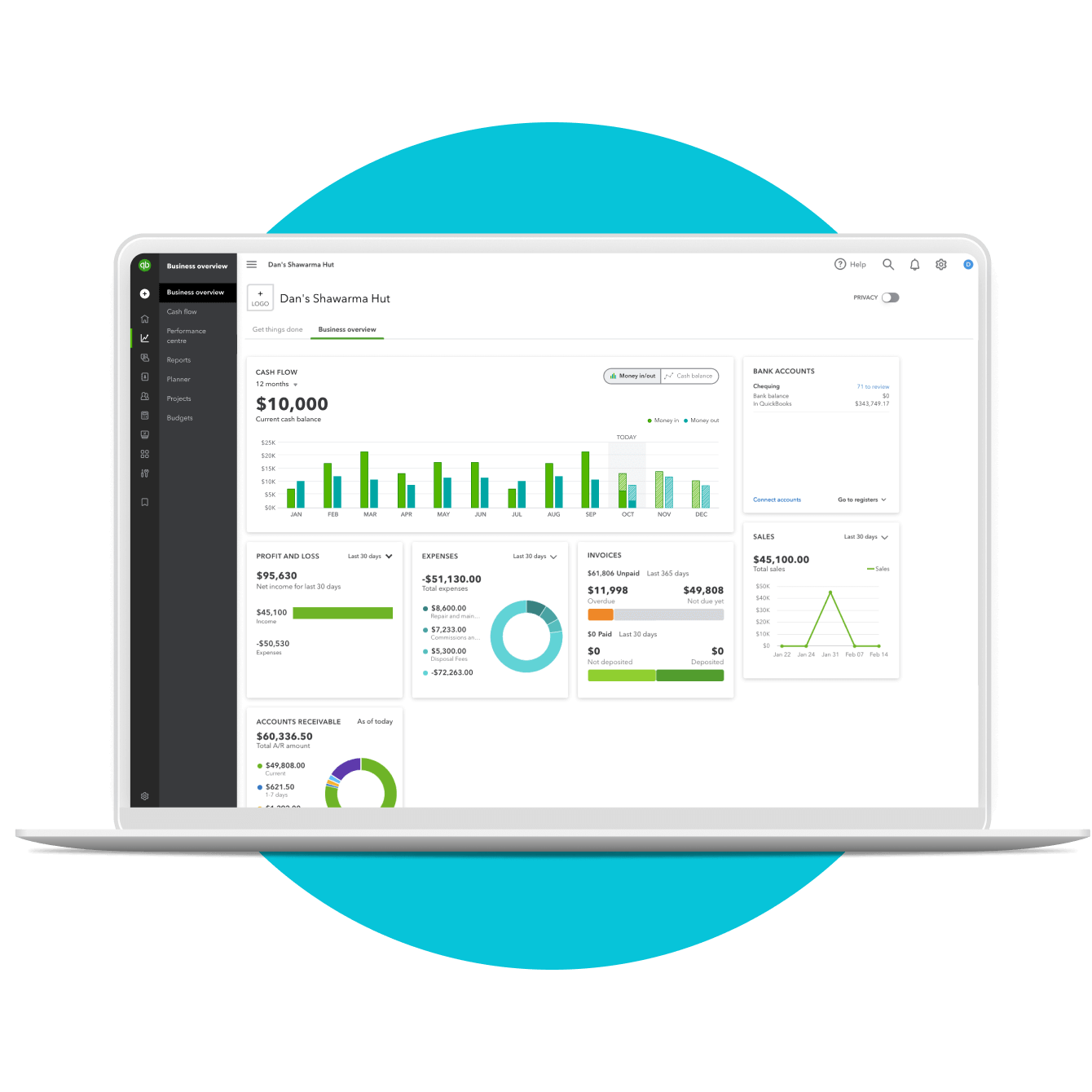

However, it does have some limitations, such as the lack of support for e-commerce and advanced reporting. If you’re a freelancer who wants simple accounting instruments and tax assist, this software program may be very helpful. But if your business grows or you want extra advanced options, you would possibly want to consider upgrading to QuickBooks On-line. Total, QuickBooks Self-Employed is a practical possibility for these just starting out or managing a small business.

How Does Quickbooks Self-employed Examine To Different Accounting Software?

This Disclaimer applies to everyone, together with, but not restricted to, guests, customers, and others who wish to entry or use the Website. By accessing or using the Website, you conform to be certain by this Disclaimer. If you disagree with any a half of this Disclaimer, then you definitely don’t have our permission to entry or use the Website. After the troubleshooting is accomplished, rerun QuickBooks Self-Employed to ensure the QuickBooks mileage tracking not working issues are resolved.

- On a Wednesday night time when I should wake up in an hour to start out driving.

- Consequently, financial benefits improve, and sustaining systematic monetary records becomes straightforward.

- It does the best job of syncing with banks, monitoring enterprise bills, and automating my bookkeeping as a driver.

- It creates risks without fixing the issue of centralized, secure mileage management.

- The Self Employed editorial policy is led by editor-in-chief, Renee Johnson.

QuickBooks has weaved the mileage monitoring function into its core capabilities, permitting users to trace mileage with much less hassle. The finest mileage tracking apps are automated—they log your trips with out you having to manually enter your starting factors and locations. Mileage tracker apps are platforms that log the mileage of your trips everytime you drive.

If they’re green, you’re good to go, however if you see an exclamation mark, make the required adjustments to your settings. As Soon As these options are configured, rerun QuickBooks Self-Employed. However, in case you are nonetheless unable to track the mileage, follow the following step. This prevents inflated claims, ensures reimbursements are accurate, and creates IRS-compliant logs you can rely on throughout an audit. With one click on, mileage knowledge (and time entries if desired) sync into QuickBooks On-line. As An Alternative of imprecise mileage totals, Timeero offers you clear, trip-by-trip documentation, making audits smoother, reimbursements accurate, and consumer billing simple.

Free Guidelines

Luckily, QuickBooks offers a easy approach to observe your mileage, making it straightforward to remain organized and compliant with IRS tips. Preserving an correct mileage log ensures that miles for enterprise trips are tracked for tax time. Swipe right on the trip to categorize it as a private journey, and swipe left to place it in a business mileage class. Hurdlr is an all-in-one monetary administration app designed for on-demand staff.

Find Out How Timeero Mileage Monitoring Features Work

We set both apps on automatic mileage monitoring and took to the highway on 30 miles journey. In Addition To that, we put in both apps on one device to ensure they have access to the same set of data or GPS coordinates. Apps like Toggl Monitor simplify time tracking with user-friendly interfaces and reporting features. If you need mileage tracking, MileIQ automatically logs your drives, making it straightforward to classify business journeys. Everlance is another glorious mileage tracker that gives computerized trip monitoring and categorization.

Paid plans range from $6 to $9 per thirty days and include more sturdy features. One Other choice is to use your car Bluetooth the place the monitoring will begin as soon as you drive over 4 MPH and cease if you disconnect your vehicle’s Bluetooth. QuickBooks On-line Easy Begin works best with the cellular app as a result of all its features can be found. Further features provided in QuickBooks Online Necessities, Plus, and Advanced plans are solely obtainable on the web. Your phone should not be linked to a Wi-Fi network whereas driving, because the journey won’t report correctly. Thus, ensure your device tracks precisely by turning off the Wi-Fi setting earlier than quickbooks mileage tracker app the journey (you can reconnect your Wi-Fi after the trip).

The Self Employed editorial policy is led by editor-in-chief, Renee Johnson. Our writers create original, accurate, partaking content material that is freed from moral issues or conflicts. Our rigorous editorial process includes modifying for accuracy, recency, and clarity. General, QuickBooks Self-Employed is designed to assist freelancers streamline their invoicing process and improve their monetary administration.

The Free plan provides sufficient for a easy operation like an Uber driver or Instacart shopper. It offers semi-automatic mileage tracking, a tax calculations abstract, and you can https://www.quickbooks-payroll.org/ export commonplace financial reports. Utilizing Solo’s “Trips” characteristic for mileage tracking is straightforward and seamless to use. Solo’s good features routinely observe your deductible miles by detecting if you end up driving, so there’s no have to manually log each start or finish of a trip. All the mileage monitoring apps listed below can be found for Android and iOS and had been chosen for their features, accuracy, cell knowledge utilization, user interface, and cost.